Facepalm: Nvidia’s highly anticipated Blackwell series of AI chips has encountered a significant setback. Newly discovered design flaws will delay shipments by at least three months. This delay will likely cause considerable disappointment among customers who have placed billions of dollars in orders.

Nvidia’s highly anticipated Blackwell series of AI chips is facing significant delays due to design flaws discovered late in manufacturing. The Information cites two anonymous sources involved with Nvidia’s chip and server hardware production, stating that the issue could take at least three months to resolve.

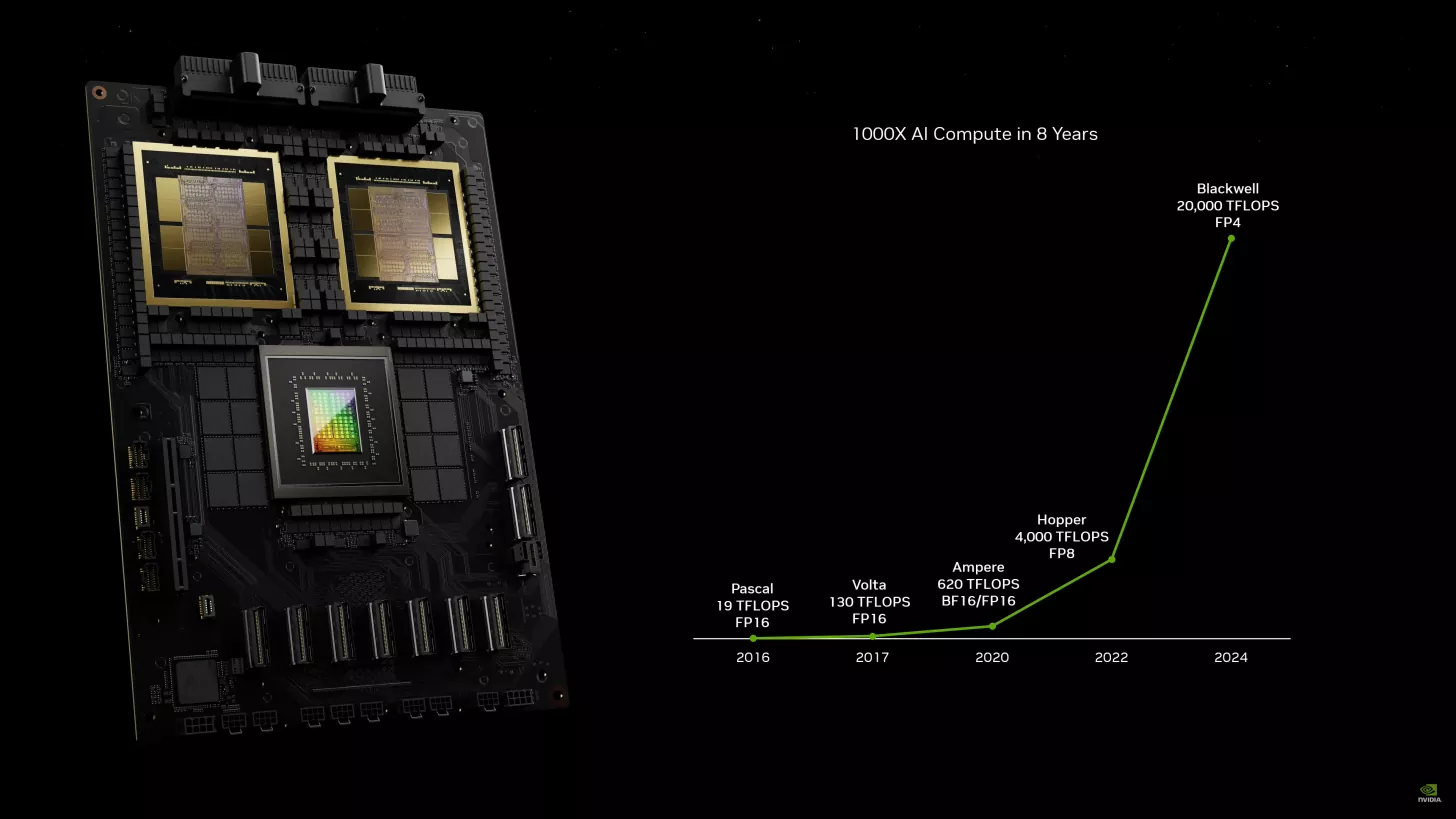

The crux of the issue lies in the processor die connecting two Blackwell GPUs on a GB200 chip – a problem identified by manufacturer TSMC. In response, Nvidia is revising the design and will need to conduct new production tests with TSMC before mass production begins. As a stopgap measure, the company is considering producing a single GPU version of the Blackwell chip to expedite delivery.

The delay has far-reaching implications for Big Tech players who have invested heavily in Nvidia’s technology. For instance, Google has ordered over 400,000 GB200 chips in a deal exceeding $10 billion. Similarly, Meta has placed a $10 billion order, while Microsoft had plans to have 55,000 to 65,000 GB200 GPUs ready for OpenAI by the first quarter of 2025 – a timeline now in jeopardy.

Nvidia has reportedly informed Microsoft and another cloud provider about the delay affecting the most advanced AI chip models in the Blackwell series. Consequently, significant shipments of these chips are not expected until the first quarter of 2025, potentially disrupting the AI strategies of these tech giants.

Despite these reports, Nvidia’s official stance remains optimistic. A company spokesperson stated that “production is on track to ramp” later this year without directly addressing the reported delay. Meanwhile, the affected companies, including Microsoft, Google, Amazon Web Services, and Meta, have declined to comment.

The setback could allow Nvidia’s competitors to gain ground in the AI chip market. Intel and AMD have struggled to impact Nvidia’s market share since the outset of the AI boom. However, the delay might let them reposition their products as viable alternatives for customers needing immediate solutions.

For instance, AMD designed its open-source ROCm framework to compete directly with Nvidia’s CUDA, offering developers an alternative to build AI applications without being locked into Nvidia’s ecosystem. Likewise, Intel is developing AI accelerator chips, including the Gaudi line, as more affordable alternatives. According to Intel, its AI accelerators are one-third to two-thirds the price of competing brands.

As customers move past the initial disappointment of the delay, they may question Nvidia’s ability to maintain its dominant 80-percent market share in the face of production challenges and increasing competition. As the AI arms race intensifies, the industry will closely watch how Nvidia navigates this hurdle and whether it can deliver on its promises to its high-profile customers.