Why it matters: Many of Nvidia’s competitors want to steal some of its market dominance. One name that keeps coming up is Broadcom. A closer look tells us why. Its XPUs consume less than 600 watts, making them one of the most power-efficient accelerators in the industry.

In a note to investors this week, Bank of America said, “Consider it a top AI pick.” It wasn’t talking about Nvidia, even though BofA considers Green Team the undisputed winner of the GPU wars. It was referring to Broadcom, which recently announced a 10-to-1 stock split and better-than-expected revenue in its second-quarter earnings report. The company projected a higher-than-anticipated $51 billion in sales for the 2024 fiscal year.

Bank of America’s analysts project the company’s 2025 fiscal year sales to be $59.9 billion, for a 16-percent year-over-year gain. Analysts point to efficiency gains from Broadcom’s VMWare acquisition last year, upsells, and its potential growth in custom chips as key indicators for its 2025 predictions. If BofA is right, Broadcom’s market cap could put it into the Trillion Dollar Club with a handful of other tech luminaries, including Microsoft, Apple, Nvidia, Amazon, Alphabet, and Meta.

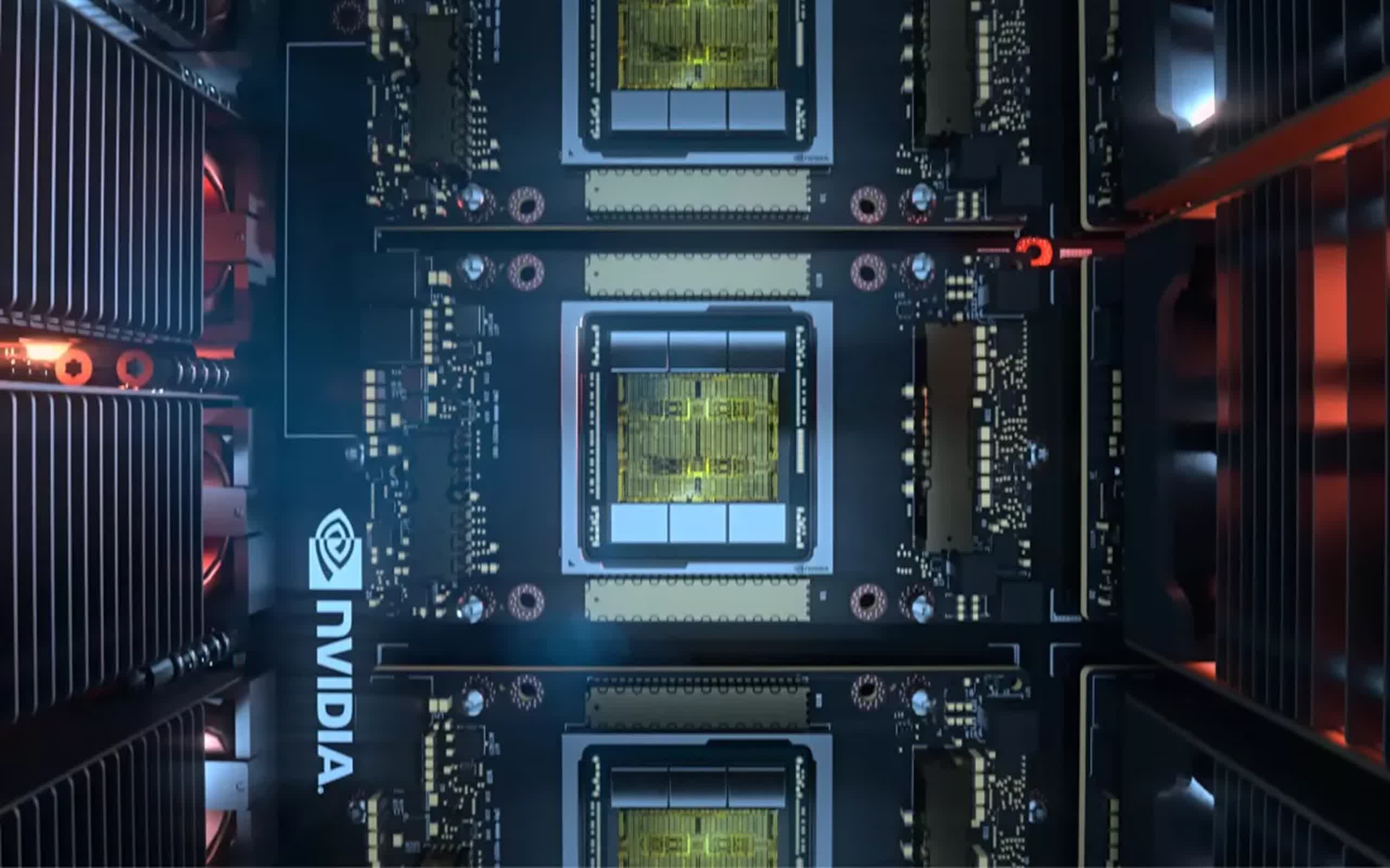

For this to happen, it will have to butt heads with Nvidia, which currently has a market cap lead of $3.4 trillion to Broadcom’s $804 billion. Moreover, Nvidia’s CUDA architecture has gained a near-monopoly in AI workloads for hyperscalers like Meta, Microsoft, Google, and Amazon, its largest customers. It has a vast ecosystem of software, tools, and libraries built around it that has further locked in customers and created a high barrier to entry for competitors like Broadcom.

Each of those companies would love to reduce their reliance on Nvidia, so Broadcom is positioning itself as an alternative by offering custom AI accelerator chips, known as XPUs, to cloud and AI companies. At a recent event, Broadcom noted that demand for its products is snowballing, pointing out that a state-of-the-art cluster two years ago had 4,096 XPUs. In 2023, it built a cluster with over 10,000 XPU nodes that required two layers of Tomahawk or Jericho switches. The company’s roadmap is to extend this to over 30,000 and eventually one million.

An advantage that Broadcom emphasizes is the power efficiency of its XPUs. At less than 600 watts, they are among the lowest-power AI accelerators in the industry.

It also has a different worldview of the chip market, which it says is moving from CPU-centric to connectivity-centric. The emergence of alternative processors beyond the CPU, such as the GPU, NPU, and LPU, requires high-speed connections, which is Broadcom’s specialty.